Are delayed payments affecting your sales cycles? Delight your customers with fast and secure payments online right after signing documents.

Allowing clients to pay online quickly eliminates delays and the risk of non-payment. Making payment collection part of your sales workflows rather than a separate process helps to increase customer loyalty and engagement.

Don’t put off taking payments! signNow makes it easy for customers to pay for your services from anywhere. Automatically accept payments right after generating quotes, negotiating prices, and signing contracts without having to switch between accounts.

Let’s take a look at how signNow does the heavy lifting so that you can focus on your goals, not paperwork.

How to connect a payment system

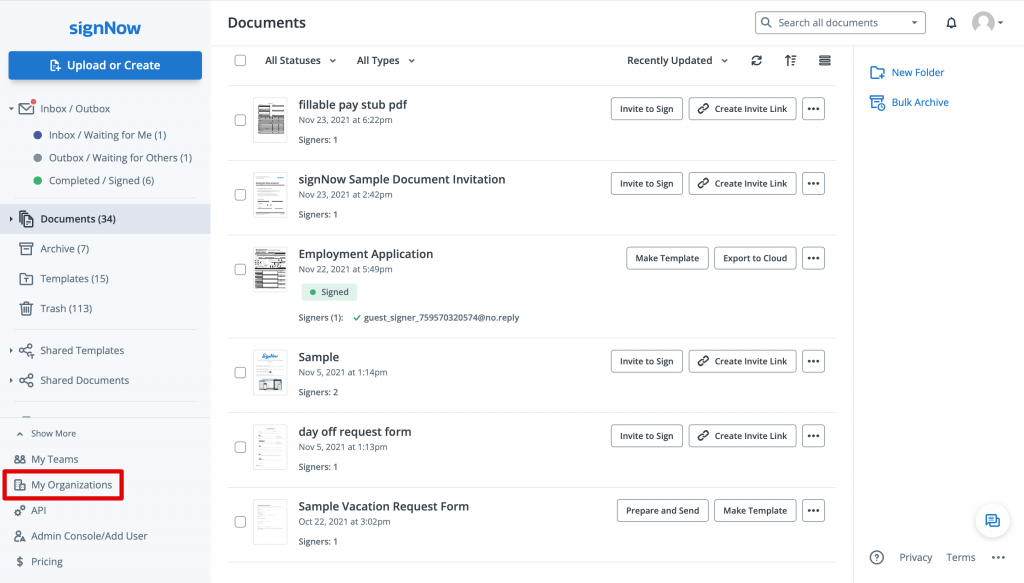

Log in to signNow using your Organization Admin account credentials. Then, click the My Organizations button at the bottom left corner of the dashboard.

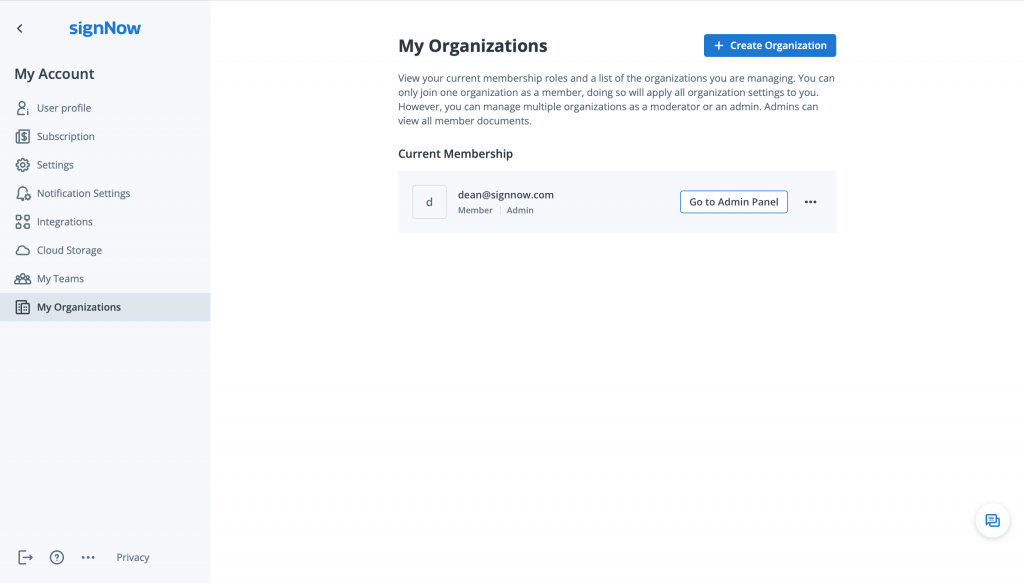

Go to the My Organizations tab and click Go to Admin Panel. You will be redirected to the Organization Admin Panel.

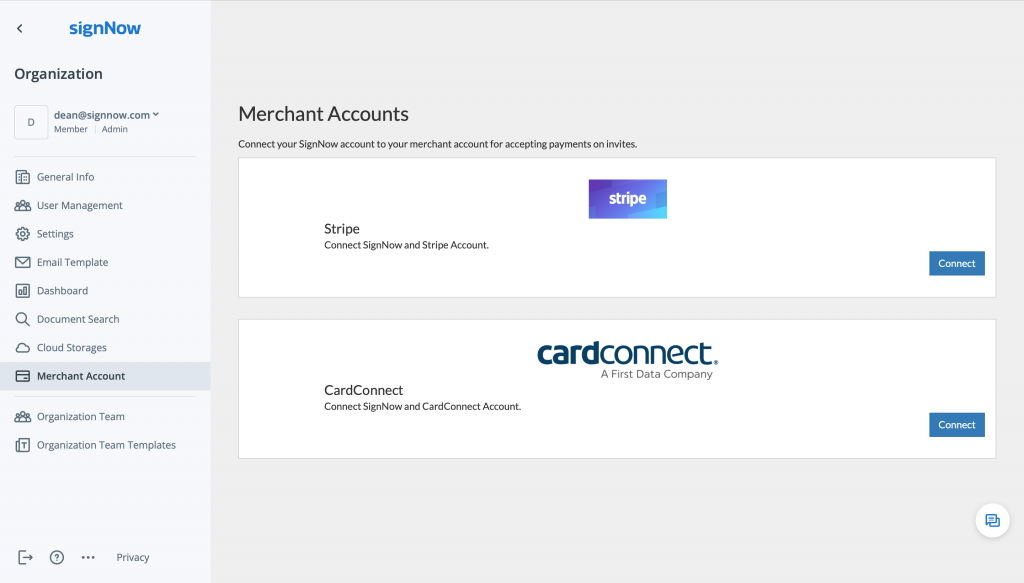

In the Merchant Accounts tab, select your payment system and click Connect. signNow allows you to receive payments via Stripe and CardConnect.

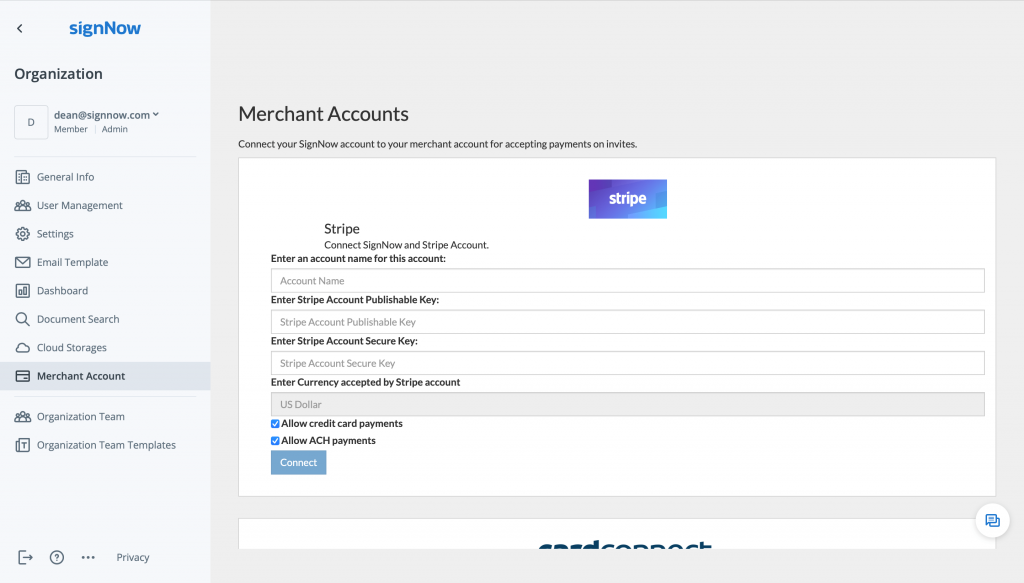

Enter your account name, payment system credentials, and select your preferred currency. Then, click Connect.

Once your Merchant Account is connected, you can request payments.

Close deals faster by allowing recipients to pay right after they sign documents

To request payments from recipients, click the user icon in the top right corner of your dashboard. Then, select My Account from the dropdown menu. Proceed to the Payment Services tab and connect to your Stripe or CardConnect account.

Next, go back to the dashboard, select the document you want to send for signing, and click Invite to Sign. Before sending the invite, click Actions on Completion and enable the Request a Payment option. Then, simply customize the form and send the invite.

Watch the video below to see how Sales departments collect payments using signNow:

signNow’s payment solution comes with three straightforward benefits for both parties:

- It’s twice as fast as a traditional paperflow purchase because it’s basically two operations in one;

- It’s twice as secure as a standard eSignature due to signNow’s encryption and advanced threat protection being supported by PCI DSS 3.2 standards on the side of the payment operator;

- It saves you time thanks to the convenient use of templates and presets available for use with advanced calculated fields.

Originally published in August 2018, updated in March 2023 for accuracy and comprehensiveness